Bitcoin Halving Explained

What is Bitcoin Halving?

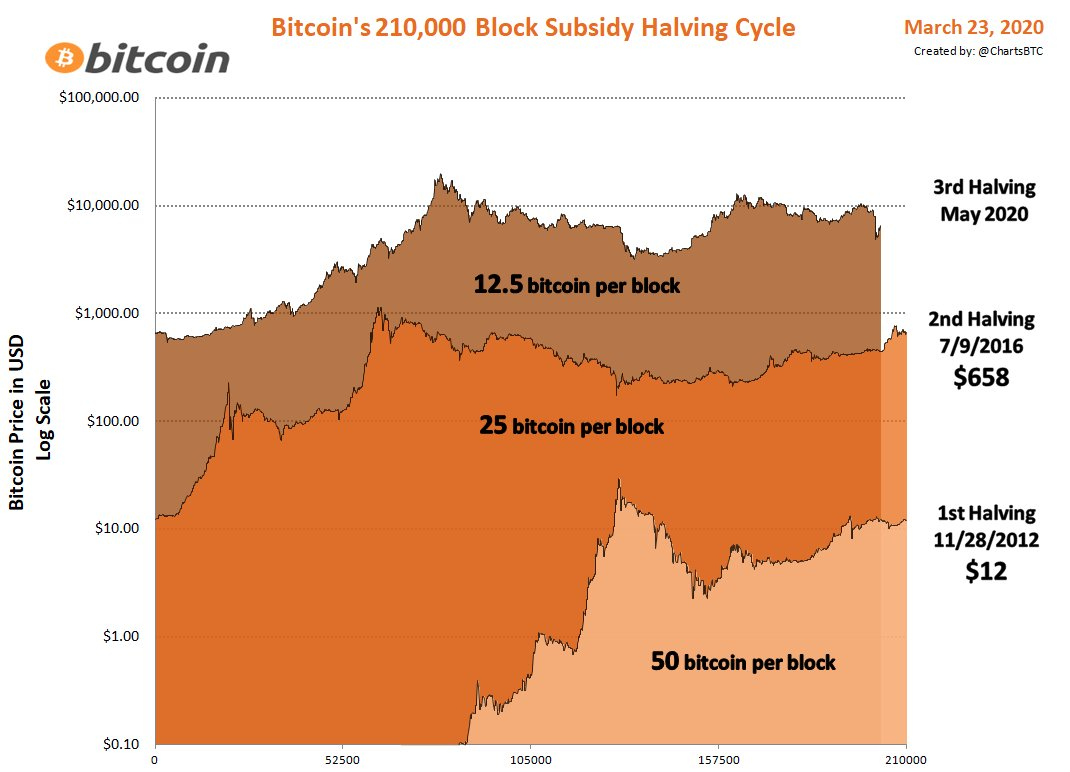

Bitcoin halving, also referred to as ‘halvening’, was designed by Bitcoin developer Satoshi Nakamoto to keep track of Bitcoin’s inflation. Halving occurs in every 4 years, where a 50% reduction in the compensation to nodes that sustain the Bitcoin network is conducted. Halving is programmed to take place on average at 210,000 blocks, and the next halving event is expected to take place at the 630,000th block. The total amount of Bitcoin mined by miners per block will be reduced from the current 12.5BTC to 6.25BTC. The BTC inflation rate will drop below the 2% inflation target utilized by most central banks for their respective fiat currencies. 18.19 million BTC — approximately 87% of Bitcoin total supply — have already been minted as of January 31, 2020.

Why is Bitcoin halving so vital?

Unlike traditional fiat currencies which can be distributed in huge amounts by central banks, only 21million BTC has been pegged to be in circulation across the globe by Satoshi Nakamoto. Bitcoin was designed as a deflationary currency just like the gold supply. Bitcoin’s monetary policy aims to ensure that the coins will remain at a down-trending inflation rate until all 21 million BTC are mined in the estimated year 2140.

The fundamental characteristics of Bitcoin halving are:

• The halving intends to ensure that that economic principle of scarcity and a specified total circulation for the Bitcoin cryptocurrency is maintained, reinforcing investability.

• A transparent and fair distribution of BTC through halving occurs over time.

• Miners are given incentives to validate transactions, which support computational power to secure the Bitcoin network.

Bitcoin halving is also of paramount importance as it enables BTC miners to receive their rewards for maintaining the value and success of the network.

When is the next halving event?

Bitcoin halving is the most anticipated event in the cryptocurrency world and the upcoming halving is expected to take place on Tuesday, May 12, 2020.

Source : chartsbtc

History of halving events dates

Blocks are added approximately every 10 minutes to the Bitcoin blockchain, as has been the case since its formal creation in early 2009. The first ever Bitcoin halving event took place on November 29, 2012 with a block height of 210,000. On July 10, 2016, the second halving occurred at block 420,000. This led to the reward block being reduced from 25 to 12.5.

What are expected to occur as we draw nearer to the halving event?

As of March 2019, 144 blocks are discovered daily, and the block reward is 12.5 BTC. This is equivalent to 1,800 bitcoins per day.

After the third halving occurs, the discovery of 144 new blocks per day at 6.25 BTC per block reward will be reduced to 900 BTC per day.

The daily minted bitcoins in USD are $16.7 million per day — based on BTC’s price at the time of writing — and this will be reduced by 50% to $8.3 million per day after the third halving.

Bitcoin will be scarcer amid a world where fiat currency is being issued in infinite supply. Morgan Creek digital analysts assert that Bitcoin will sink lower as the halving event approaches, and it will take time to rise. Morgan Creek said this will happen probably in September 2020. Overall, many assume that the halving event will have a dramatic effect on Bitcoin's price since the halving basically cuts the supply of new bitcoins in half.

One day average mining hashrate of the Bitcoin blockchain

Blockchain analysis firm Glassnode reported that the one-day average mining hash rate of the bitcoin blockchain reached 139 exahashes per second on May 3. The hash rate is not stagnant; it may rise or fall depending on the miners’ contribution to the Bitcoin network. The hash rate measures how much computer processing power is being utilized by the Bitcoin network.

How to purchase Bitcoin?

Bitcoin can be purchased from various cryptocurrency exchanges and some Bitcoin-affiliated companies that have proven their credibility over time.